In 2020, under the stimulation of “internal circular economy”, the domestic truck market ushered in a growth against the trend; however, the overseas market is not so lucky, and the spread of the global epidemic has had a certain impact on the truck export market in 2020. According to the customs data, in 2020, China’s truck exports totaled 195264, a year-on-year decrease of 8.6% (213579 trucks in 2019);

What are the characteristics of China’s truck export market in 2020? To which country? How should export automobile enterprises break through the cocoon and get out of the predicament? Now carry on the simple summary analysis, for the industry reference!

1、 Summary of the characteristics of China’s truck export market in 2020

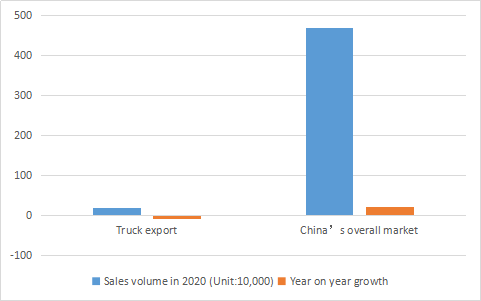

Feature 1: in 2020, the truck export market will drop by 8.6% year on year, which is lower than the overall truck market

According to the data of customs and CAAC

|

|

Truck export |

China’s overall market |

|

Sales volume in 2020 (Unit:10,000) |

19.5264 |

468.5 |

|

Year on year growth |

-8.6 |

21.7 |

What are the characteristics of China’s truck export market in 2020? To which country? How should export automobile enterprises break through the cocoon and get out of the predicament? Now carry on the simple summary analysis, for the industry reference!

1、 Summary of the characteristics of China’s truck export market in 2020

Feature 1: in 2020, the truck export market will drop by 8.6% year on year, which is lower than the overall truck market

According to the data of customs and CAAC

|

|

Truck export |

China’s overall market |

|

Sales volume in 2020 (Unit:10,000) |

19.5264 |

468.5 |

|

Year on year growth |

-8.6 |

21.7 |

As can be seen from the above chart, in 2020, the truck export market dropped by 8.6% on a year-on-year basis, 30.3 percentage points lower than the growth rate of 21.7% in the overall truck market, which obviously lost the overall truck market and became a “stumbling block” for the growth of the truck market.

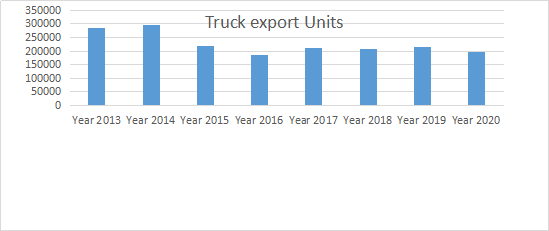

Feature 2: in 2020, the number of truck exports is the second lowest in the past eight years, and the year-on-year decline rate is the fourth

According to the export data of Customs in recent years, China’s truck export and year-on-year growth in 2020 and recent 8 years are as follows:

As can be seen from the above chart, in the truck export market in the past eight years, the number of trucks exported in 2020 was 195264, ranking the second lowest, only slightly higher than the lowest in 2016 (also the second year when the number of exports was less than 200000), with a year-on-year decrease of 8.6%, ranking the fourth largest in the past eight years, indicating that the overseas epidemic still has a great impact on China’s truck export market in 2020.

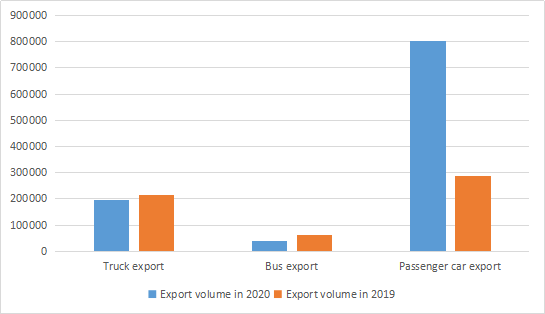

Third, in 2020, in the export market of commercial vehicles, the year-on-year decline of truck export is less than that of commercial vehicle export by nearly 9.4 percentage points, which is better than that of commercial vehicle export market

According to customs data, the year-on-year growth of truck exports in 2020 is compared with that of commercial vehicles:

It can be seen that in the commercial vehicle export market in 2020, the year-on-year decline of truck export is 9.4 percentage points smaller than that of commercial vehicle export. In other words, truck export outperforms the commercial vehicle export market, which is the main “hero” restraining the sharp decline of commercial vehicle export market in 2020.

Feature 4: in 2020, truck export has the smallest decline among all segments of the overall automobile export market, which is the “lightest” segment of the automobile market hurt by the epidemic.

According to the data of customs and China Automobile Circulation Association, in 2020, the number, year-on-year and proportion of automobile export in each market segment are as follows:

It can be seen that in 2020, the export of trucks has the smallest year-on-year decline, and it is the most vulnerable market, accounting for 18.5% of the automobile export market, ranking second. There are two main reasons:

First, our trucks are mainly exported to some economically underdeveloped countries in Asia, Africa and Latin America, with lower prices and more practical, which are indispensable production tools in infrastructure projects in these countries;

Second, although these countries are affected by the epidemic, trucks are just needed for the freight market, such as transporting disaster relief drugs and anti epidemic materials; while passenger cars are basically consumer goods, the economy is generally depressed under the influence of the epidemic, and the demand for purchasing consumer goods is bound to decrease; in addition, buses are mainly tools for carrying people, and under the influence of the epidemic, the passenger transport, tourism and public transport markets of exporting countries are affected As a result, the bus export has the largest year-on-year decline, which is the same as the domestic bus market.

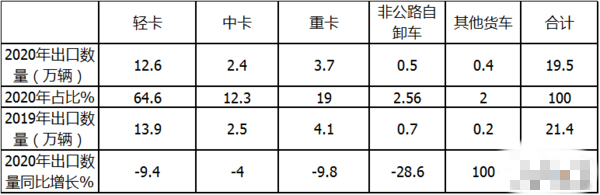

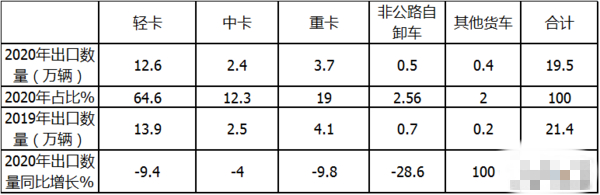

Feature 5: in 2020, the export volume of light truck (including pickup truck and micro truck, the same below) is the largest, with a year-on-year decrease of 9.4%; the export volume of heavy truck is the second, with a year-on-year decrease of 9.8%; the export volume of medium truck is the third, with a year-on-year decrease of 4.0%; the export volume of off highway dump truck is the largest

According to the customs data, in 2020, the export volume and proportion of trucks in each market segment are as follows:

It can be seen from the above chart that in 2020, in each segment of truck export market:

The number of light truck exports was the largest, with a year-on-year decrease of 9.4%, accounting for 64.6%;

The second is the export quantity of heavy trucks (what is the most popular tank trailer in nigeria?), which decreased by 9.8% year on year, accounting for 19.0%; the third is the export quantity of China truck, which decreased by 4.0% year on year, accounting for 12.3%

The off highway dump truck market with the largest decline in export was 28.6%, and other trucks had the largest year-on-year growth, but the base was small.

Feature 6: according to the type of fuel, diesel trucks accounted for 65% of the export truck products, and the proportion increased by 6 percentage points year on year; gasoline trucks accounted for 31%, and the proportion decreased by 6 percentage points year on year

Feature 7: among the export diesel trucks, trucks of less than 5 tons account for 34% of the total export volume of trucks, which is the largest; trucks of more than 20 tons account for 16%; trucks of 5-14 tons account for 12%

Feature 8: among the export gasoline trucks, trucks under 5 tons account for 30% of the total export volume of trucks, which is the largest; others are zero

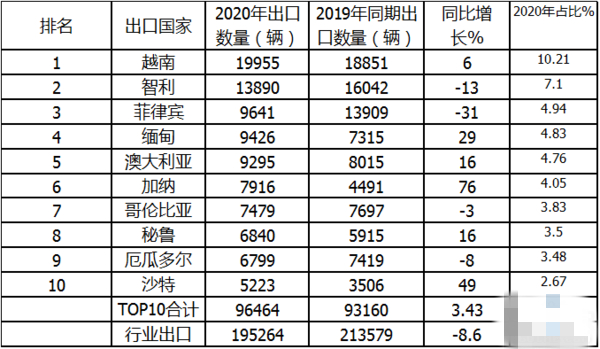

Feature 9: the export flow is uneven. Among the top 10 countries in China’s truck export flow in 2020, Vietnam accounts for 10.21%, ranking first; Chile accounts for 7.1%, ranking second; the Philippines accounts for 4.94%, ranking third; the cumulative proportion of top 10 countries is nearly half of the country, with a year-on-year concentration increase of 5.7%. This shows that China’s truck export market is less affected by the epidemic, and the risk increases

According to the statistics of customs and China Automobile Circulation Association, the top 10 countries of China’s truck export flow in 2020 are as follows:

As can be seen from the above chart, the main trend of China’s truck export in 2020 is as follows:

1.Vietnam is the country that exports the most trucks in China, with a market share of more than 10%. It is also the only country that exports nearly 20000 trucks, accounting for more than 10%, and the export volume increased by 6% on a year-on-year basis;

2. It exported 13890 vehicles to Chile, accounting for 7.1%, but the sales volume dropped by 13% year on year, ranking second;

The top two countries, Vietnam and Chile, are the two countries that export more than 10000 trucks in 2020, and the third and tenth countries export less than 10000 trucks

3. 9641 Philippine vehicles were exported, down 31% year on year, accounting for 4.94%, ranking third; the best selling 60ton lowbed trailer in philippine.

4. 9426 vehicles were exported to Myanmar, with a year-on-year increase of 29%, accounting for 4.83%, ranking fourth;

5.It exported 9295 vehicles to Australia, with a year-on-year growth of 16%, accounting for 4.76%, ranking fifth;

It can be seen that from the third to the fifth, the number of exports is between 9000 and 10000.

In the top 10, the year-on-year growth rate was 6% and the year-on-year decrease rate was 4%. Ghana was the largest with a year-on-year increase rate of 76%, and the Philippines was the largest with a year-on-year decrease rate of 31%.

Top 10 accounted for 49.3% of the total, with a year-on-year increase of 5.7 percentage points (accounting for 43.6% in 2019),

Overall, half of China’s truck exporting countries will be concentrated in the above-mentioned 10 countries (mainly in Asia and Latin America) in 2020, and the degree of market concentration will be improved, which means that the epidemic situation will make China’s truck exporting countries more concentrated, narrow the market scope, and increase the market risk.

In addition, it is worth noting that South Africa, Tunisia, Algeria, Cuba and other countries with more truck exports in China before 2019 have disappeared in the top 10 of 2020, indicating that China’s truck export market is unstable and changing rapidly.

2、Under the post epidemic situation, how should export automobile enterprises break through the cocoon and move forward?

Despite the past, novel coronavirus pneumonia is still spreading worldwide in 2020. After the epidemic, China’s truck export will not be smooth sailing, truck export trade may also face difficulties.

Therefore, China’s truck export can be solved with the efforts of auto enterprises and the help of the government. Automobile enterprises can solve the problem by adjusting their export strategies, expanding domestic market demand, and transforming. In addition, they can seek the government’s help and support in terms of fiscal revenue, financial insurance, industrial chain supply chain and other aspects, so as to reduce the pressure of export automobile enterprises. Under the post epidemic situation, how can automobile enterprises break the cocoon and save themselves?

First, we should seize the opportunity to speed up the elimination of the third national economy and the development of “new infrastructure”, actively take advantage of China’s “internal circular economy”, expand the domestic market, and make up for the loss of overseas markets from more domestic market demand;

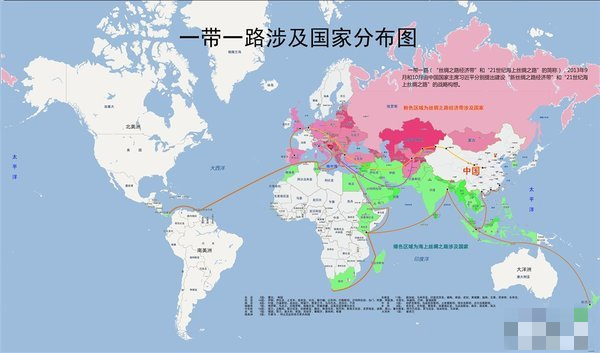

Two, one belt, one road, the other side of the country and the other areas along the border should be closely monitored and closely linked to overseas markets.

One belt, one road, one belt, one road, will continue to seize the market opportunity. As one belt, one road continues to develop one’s quality, the one belt, one road “will continue to contribute new growth points to our truck companies in developing overseas markets.

Adjust the market direction and expand exports to countries or regions with low epidemic risk. For example, the export focus can be mainly adjusted to the regional markets with relatively low epidemic risk;

Third, make full use of cross-border e-commerce platform to increase export sales channels;

Fourth, strengthen communication with overseas partners to reduce panic and rebuild the confidence of overseas customers;

Fifth, based on the long-term development, adjust the product structure and increase the research and development of new truck products.For example, we should increase the research and development of high-end truck products, adjust the product structure, broaden the product range, meet the demand of some import markets, and prepare for the recovery of overseas market demand after the epidemic.

For example, SINOTRUK, which has long been the first exporter in the heavy truck industry, has a very rich product line in terms of export products. It has unique engineering vehicles (mixer, dump truck, etc.), gas-fired heavy trucks with high cost performance, and bright tractors. From the perspective of price echelon, it has high, medium and low-end products. Its products cover heavy truck, medium truck, light truck and special vehicle series, with a full range of products Column.

Sixthly, we should pay attention to innovation in brand communication to enhance the international popularity and market position of our trucks. For example, Dongfeng Motor Co., Ltd. was named “Dongfeng” again a few years ago, formed Dongfeng team to participate in Volvo round the world yacht race, and docked at many ports. Combined with the local wind culture of various countries, it carried out a series of eye-catching brand communication and product promotion, and achieved good results. This is a good practical case of brand communication innovation, and other automobile enterprises can according to their own characteristics The actual situation can be used for reference.

Conclusion: under the influence of the epidemic situation, the truck export market in 2020 is a year with a small number of exports in recent years, with a year-on-year decrease of 8.6%;

In terms of fuel types, diesel power exports are the most; in terms of tonnage, light truck (including pickup truck and micro truck) exports account for the largest proportion;

From the perspective of flow direction, the export to Vietnam is the most, but the concentration of truck export market in China has increased, the market area has narrowed, and the market risk of truck export has increased;

One belt, one road, the regional and the other side markets, should be focused on, and the market strategy should be adjusted. The cross-border e-commerce platform will be used to increase export channels, adjust the structure of export products and focus on brand communication and innovation. It is believed that under the post epidemic situation, China’s truck export market will improve in 2021. The industry will pay close attention to the details.

Post time: Mar-15-2021